403b Contribution Limits 2025

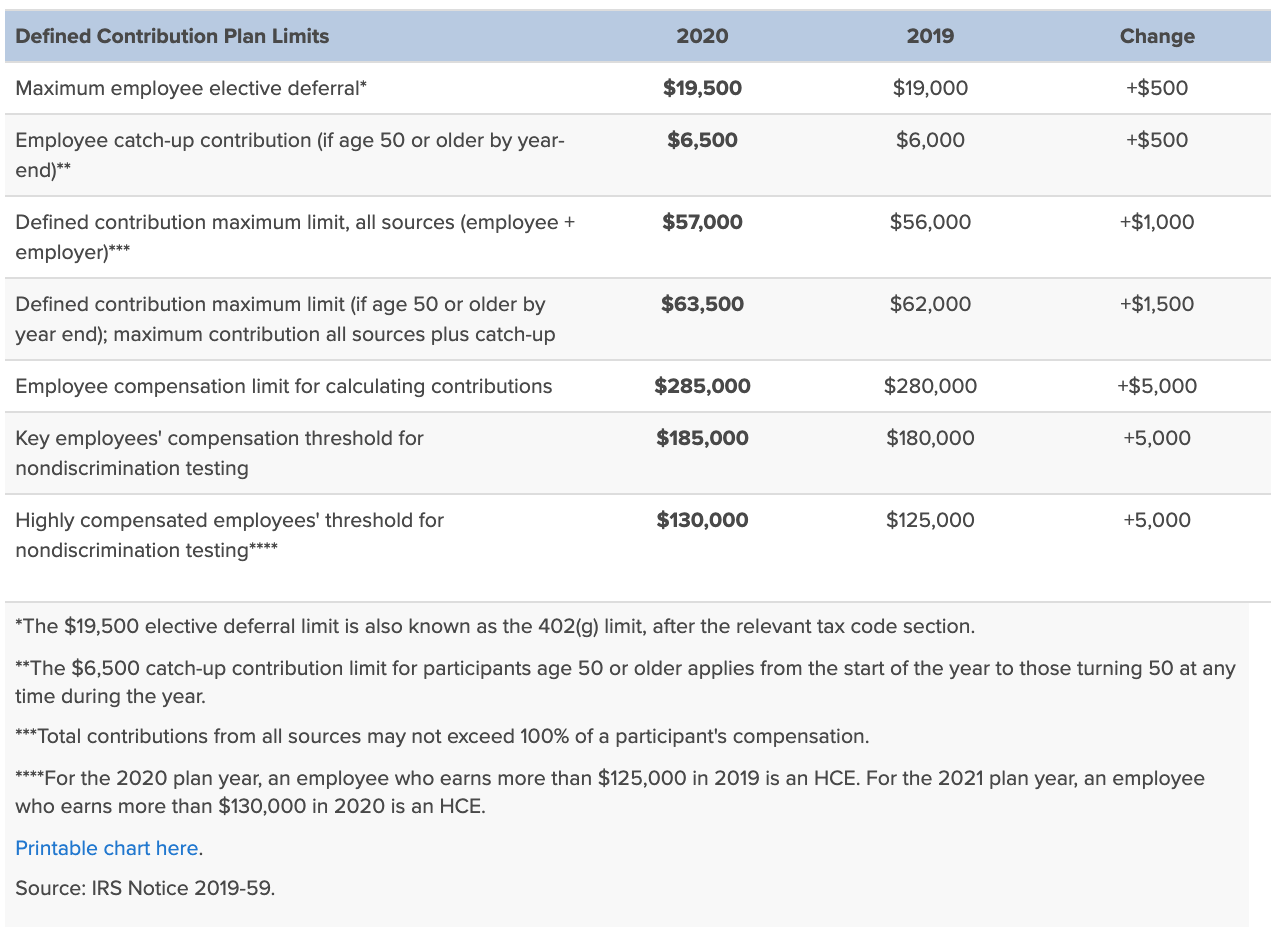

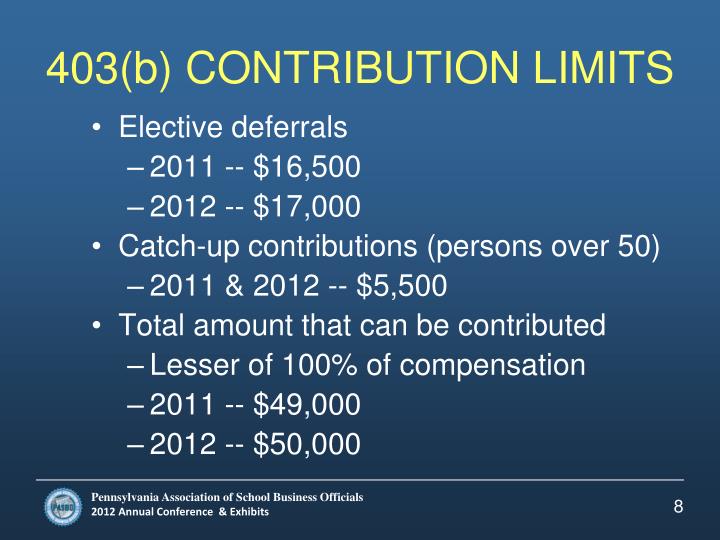

403b Contribution Limits 2025 - self directed 401k contribution limits 2025 Choosing Your Gold IRA, 403(b) contribution limits in 2023 and 2025. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:. 2023 Retirement Plan Limits KerberRose Retirement, You can tuck quite a bit away into your 403 (b) plan, but the irs does set limits to how. Under the 2025 limits, the 403 (b) retirement plan maximum contribution, as an elective deferral, is $23,000.

self directed 401k contribution limits 2025 Choosing Your Gold IRA, 403(b) contribution limits in 2023 and 2025. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

Plan Sponsor Update 2023 Retirement Plan Limits Midland States Bank, The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401 (k), 403 (b), and 457 (b) plans, as well as income. The 403b contribution limits for 2025 are:

403(b) Contribution Limits For 2023 And 2025, 403 (b) contribution limits consist of two parts: The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year.

Employees will be able to sock away more money into their 401 (k)s next year.

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, Employees who qualify may be able to defer up to $26,000 in 2025. The annual 403 (b) contribution limit for 2025 has changed from 2023.

403b Contribution Limits 2025. Employees who qualify may be able to defer up to $26,000 in 2025. Employers that sponsor a simple plan may allow increased salary deferral limits for their employees, starting in tax year 2025.

Retirement plan 415 limits Early Retirement, 100% of the participant’s compensation; 1) 401 (k), 403 (b), 457 plans, thrift savings plan 2025.

Max has determined that the limit on annual additions for 2025 is $69,000 and the.

403(b) Contribution Limits For 2023 And 2025, The contribution limit for employees who participate in 401 (k), 403 (b), and most 457. Find out more about the 2025 defined benefit plan limits.

The contribution limit for employees who participate in 401 (k), 403 (b), and most 457. The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401 (k), 403 (b), and 457 (b) plans, as well as income.

2025 403(b) and 457(b) Max Contribution Limits Remain Unchanged, The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year. Roth 403b contribution limits 2025.the maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2023.